BitcoinDark BTCD Mining Power Consumption

Aug 5, 2017 - First announced in November 2017, the new Halong Mining DragonMint 16T miner is the result of 12 months of R&D and a $30 million investment in development. It has a hashrate of 16th/s with a power consumption of 1440–1480 watts optimized for 240v operation. The DM8575 ASIC runs at 85 GH per. I know so far it has mostly been about the mining and I would think that BTCD community did more hash in its first week than any other coin. Again back to the computer analogy, you want the best CPU, the best hard drive, the best RAM, the best monitor, the best power supply, etc. One weak link and it. The solution to this problem is to invest in a computer specialised for the purpose of mining. It's main particularity? As you would've guests: a very good ratio of electric consumption compared to the calculation power. But this means that you have to invest a big amount of money upfront (usually these kind of computers start.

Bitcoin’s ongoing meteoric price rise has received the bulk of recent press attention with a lot of discussion around whether or not it’s a bubble waiting to burst. However, most the coverage has missed out one of the more interesting and unintended consequences of this price increase. That is the surge in global electricity consumption used to “mine” more Bitcoins.

How Does Bitcoin Mining Consume Electricity? At a very basic level Bitcoin mining requires expensive and power hungry computer hardware. Nexus NXS Mining Income. As the the: Mining power is high and getting higher, thanks to a computational arms race. Recall that the required number of zeros at the beginning of a hash is tweaked biweekly to adjust the difficulty of creating a block—and more zeros means more difficulty. The Bitcoin algorithm adds these zeros in order to keep the rate at which blocks are added constant, at one new block every 10 minutes.

The idea is to compensate for the mining hardware becoming more and more powerful. When the hashing is harder, it takes more computations to create a block and thus more effort to earn new bitcoins, which are then added to circulation. According to, as of Monday November 20th, 2017 Bitcoin’s current estimated annual electricity consumption stands at 29.05TWh. That’s the equivalent of 0.13% of total global electricity consumption. While that may not sound like a lot, it means Bitcoin mining is now using more electricity than 159 individual countries (as you can see from the map below). More than Ireland or Nigeria. If Bitcoin miners were a country they’d rank 61st in the world in terms of electricity consumption.

Here are a few other interesting facts about Bitcoin mining and electricity consumption: • In the past month alone, Bitcoin mining electricity consumption is estimated to have increased by 29.98% • If it keeps increasing at this rate, Bitcoin mining will consume all the world’s electricity by February 2020. • Estimated annualised global mining revenues: $7.2 billion USD (£5.4 billion) • Estimated global mining costs: $1.5 billion USD (£1.1 billion) • Number of Americans who could be powered by bitcoin mining: 2.4 million (more than the population of Houston) • Number of Britons who could be powered by bitcoin mining: 6.1 million (more than the population of Birmingham, Leeds, Sheffield, Manchester, Bradford, Liverpool, Bristol, Croydon, Coventry, Leicester & Nottingham combined) Or Scotland, Wales or Northern Ireland.

• Bitcoin Mining consumes more electricity than 12 US states (Alaska, Hawaii, Idaho, Maine, Montana, New Hampshire, New Mexico, North Dakota, Rhode Island, South Dakota, Vermont and Wyoming) All maps created using. Bitcoin Mining Electricity Consumption Vs Countries The map above shows which countries currently consume more or less electricity than that consumed by global Bitcoin mining. The map below shows how much more or less bitcoin mining energy consumption compares to each countries energy usage with 100% being equal. Ireland currently consumes an estimated 25 TWh of electricity per year, so global Bitcoin mining consumption is 116%, or 16% more than they consume. The UK consumes an estimated 309 TWh of electricity per year so global Bitcoin mining consumption is only equivalent to 9.4% of the UK total. Global Bitcoin Mining consumption compared to each country’s electricity consumption The map below shows which countries in Europe consume more or less electricity than Bitcoin mining: Which European countries consume more or less electricity than the amount consumed by global bitcoin mining As mentioned, above the data for Bitcoin mining energy consumption comes from the. You can read about their.

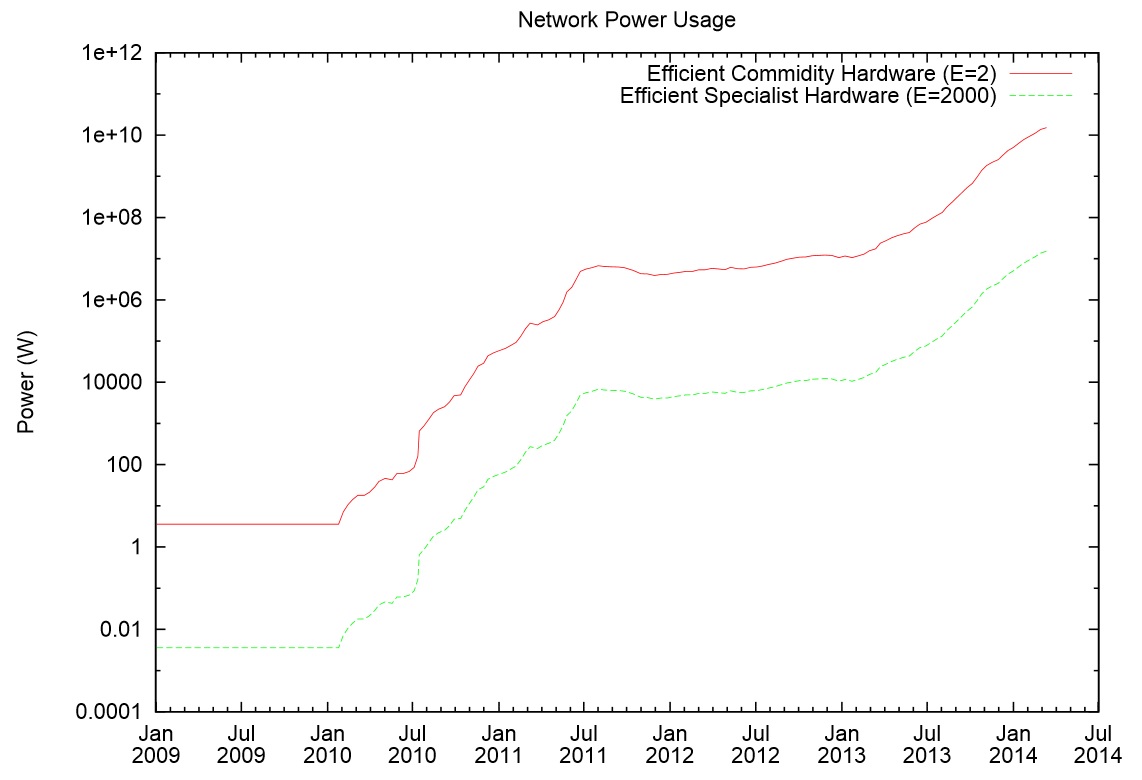

Electricity consumption data mostly comes from the CIA via and is mostly for 2014, since that’s the most recent year available. Unlike some other sources it includes, residential, commercial and industrial use, so may be higher than other figures quoted elsewhere. Bitcoin Mining Electricity Consumption Vs US States While doing the research we also though it might be interesting to compare Bitcoin mining energy consumption to US states. So we created the map below: Overall, 12 States consume less electricity than Bitcoin Mining (Alaska, Hawaii, Idaho, Maine, Montana, New Hampshire, New Mexico, North Dakota, Rhode Island, South Dakota, Vermont and Wyoming). Growth of Bitcoin Mining Electricity Consumption While Bitcoin Mining is only currently consuming 0.13% of the world’s electricity output, it’s growing incredibly quickly. The Bitcoin Energy Consumption Index estimates consumption has increased by 29.98% over the past month.

If that growth rate were to continue, and countries did not add any new power generating capacity, Bitcoin mining would: • Be greater than UK electricity consumption by October 2018 (309 TWh) • Be greater than US electricity consumption by July 2019 (3,913 TWh) • Consume all the world’s electricity by February 2020. (21,776 TWh) The Cost of Mining Bitcoins The Bitcoin Energy Consumption Index estimates that the total annual cost of mining Bitcoins stands at $1.5 billion (£1.1 billion). However, that assumes Bitcoin mining is occurring in places with cheap electricity (not an unreasonable assumption). The US average retail price per kilowatthour is 10.41 cents, which means using 28.05 TWh would cost: $3.02 billion (£2.28 billion). In the UK it would even more expensive, assuming you paid the rock bottom price of 10.10 pence per kilowatthour ( for London homes) it would still cost £2.93 billion ($3.89 billion).

Interestingly, Bitcoin’s price increase over the last month has been just over 40%, which is greater than the increase in electricity consumption. This means the estimated annualised global mining revenues now stand at $7.2 billion USD (£5.4 billion), which even at the more expensive estimates listed above, means it’s still very profitable. I am still completely convinced IT guys, who work for organizations over 2,000 employees, have these mining operations running inside their data centers, allocating massive amounts of virtual computing power to the operation.perhaps during non-peak hours, while punching whatever hole they need through the firewall.this allows the miners to 'mine' at no cost (to themselves), so it doesn't matter how 'expensive' it gets.and, will McAfee and the security software guys have sniffers for mining traffic? Not my world there.but I've never heard of it. Totally ignorant article and totally ignorant comments.The electricity consumption of the BTC/BCH network will increase in line with price, which is currently rising exponentially, but won't do so forever (again, it is and will continue to follow the technological adoption S-curve). The consumption of electricity is definitely a FEATURE, as any attack on the network has to overcome the entire amount of energy the network expends times the total amount of hash power the network has. Even the dimmest oldbug should be able to see that that simply is not economical, even for a nation state!

I am wondering how many feet of manure are currently covering the streets in London. In 1894 it was projected by the Times of London that the streets would be under 9 feet of manure in 50 years. Presumably it would be much deeper by now. I have not been there, but some recent videos I have seen indicate some problems with certain immigrants, but I saw no evidence of any problem from deposits of horse waste. Does anyone here have any first hand information. I also recall that similar projections were made regarding NY City, but I cannot find any evidence that such a problem occurred there either. It seems strange that experts could apparently be completely wrong in both cases, so I must be missing something.

Can't make jewelry with it, can't eat it, can't make any practical use of it for even one minute ever. However, everybody wants it BECAUSE EVERYBODY WANTS IT!!! Even though IT HAS ABSOLUTELY NO ACTUAL VALUE WHATSOEVER!!!We need not worry too much about the (hypothetical) future of cryptocurrencies. They are primarily harbingers of what is to come. We have traded essential expertise, such as knowledge of physics or medicine, for artificial expertise, such as knowledge of proprietary software or abstract financial instruments. And also we have traded essential utilities, such as energy or food, for abstract artificial utilities, such as licenses or Bitcoin.

We are burning fuel to create cryptocurrency, for example.This is an omen, a symptom of advancing civilizational entropy, leading to civilizational collapse. Don't worry about the future of Bitcoin. Worry about your own future, which the advent of Bitcoin presages. Thanks for mentioning the S curve.

Speculative Bitcoin Adoption/Price Theory 'Amara’s Law: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”. 'Basically, for anything new there is a mad flurry of excitement over potential applications, followed by the realization that most of them don’t work, followed by a slow learning of what does work, followed by sustained progress.' 'a bitcoin bubble does not reach a steady state of gradual increase. As mentioned before, it must continue to follow the exponentially increasing path of the S-curve. Why then does it follow the hype cycle at all? This is because the nature of bitcoin investment is almost entirely speculative. Speculation is driven, in large measure, by hype.'

Repeat for emphasis: 'This is because the nature of bitcoin investment is almost entirely speculative. Speculation is driven, in large measure, by hype. Vertcoin VTC Miner Computer. ' The S curve's Y axis is percent of Market Share. How big is the market for Bitcoin?

The 21 million Bitcoins? Everyone who matters using or collecting Bitcoin?

Where do you think Bitcoin is on the S-curve? >Where do you think Bitcoin is on the S-curve?Bitcoin (Core) has reached the end of its useful life, but crypto will live on.We have yet to reach 1% adoption. It has quite a ways to go. If Core got their shit together and got those fees down in a sustainable way such that their network was no longer vulnerable, then BTC would have about a 2500x run to go. Far more likely that ETH, BCH, or some other coin takes the top spot within a year. If that is the case, then those coins of course would have far further to run--7500x and 12500x respectively (numbers are all approximate and assume a single victor that takes over the function of broad money in the world economy). When the concept of nanotechnology was introduced there was a scare about 'grey goo' (ie) nanomachines converting everything to more nanomachines.It is now clear that Bitcoin is a virulent memetic entity, a kind of parasitic idea that lodges in humans' minds and persuades them to rearrange all matter into configurations that compute the SHA256 algorithm.The Bitcoin network will spawn a noneudaimonistic, self-replicating monster (a 'dragon', in the jargon of Hannu Rajaniemi) that devours all life in the solar system.

The universe will, once again, be nothing but nonconscious dust.Better pucker your bungholes mates! Everyone seems to forget the main issue here. Who will pay for the electricity bill? The greater fools?Bitcoin's calculations are completely useless and generate no actual value (except more and more bitcoins) and, like any currency, it doesn't pay any dividend or produce real products. Since it demands lots of energy and produces nothing, it's a negative-sum game.The greater fools will pay this electricity bill, and it will not be cheap.

It's getting more and more expensive.Anyway, your reasoning that consumption of electricity is directly proportional to computer power is garbage. Just compare a simple cellphone and the first computer, the ENIAC: the cellphone uses 500000X less power, but is 2300X times more powerful. In the future, perhabs even at this moment, powerful men have access to quantum computers, DNA computing processors, and other technologies, and all buttcoin's hashpower will be nothing to them. >Who will pay for the electricity bill?The miners. This should be obvious to you.If the price of energy gets too high, miners will go out of business, the difficulty adjusts downwards, and the equilibrium is maintained.>Anyway, your reasoning that consumption of electricity is directly proportional to computer power is garbage.You are hallucinating.

I never said that. I said consumption of energy is proportional to the PRICE OF BITCOIN. And the proportion is decreased by half each time the block reward halves.