Miner Litecoin LTC 2018

Litecoin (LTC), after announcing WordPress Plugin is back at 104 USD today. This a huge step for the cryptocurrencies that are currently using Lightning Network (Bitcoin (BTC) and Litecoin (LTC)). Microtransactions will continue to bring great usability to coins that use this network. WooCommerce represents about 20% of e-commerce worldwide through platforms like WordPress. A new plugin in development called ZAP will be targeting microtransactions through LN (Lightning Network). If this market quota really is wishing for this to happen, which we can assume that by now a lot of it does, once this plugin is fully deployed many of the ecommerce businesses will start to immediately be able to receive both Litecoin (LTC) and Bitcoin (BTC) as forms of payment. This will make a dent on the 5 trillion-dollar industry of ecommerce payments run by PayPal. This could really be game-changing in predicting how soon the market will break the trillion-dollar industry milestone. The Past isn’t necessarily a reflection of the future but when comparing Bitcoin, that more than ten-folded its value this year, with Litecoin, that holds nearly a 2800% in gains, we see that Litecoin (LTC) seem to take over the race at least on a microtransactions level.

Market Analisys After this week’s most recent slide we’re able to take another look at the difference in between the ups and the downs of Litecoin(LTC). On average, each upwards trend lasts for 170% and in each slide usually around -26%. Like I said, this might not continue to be observed but at least it’s the trend. Let’s look at the most recent November cycle. Image 1 – Litecoin (LTC) Charts Source: Repetitive warnings of a bubble keep coming but the slides keep insignificant towards the gains. This was a great year for Litecoin(LTC), the gains mentioned above made an impact on the community that expected great things. Like I said in a previous article about what to do when markets take a crash, a fan of Litecoin usually stays a fan of Litecoin.

Link: What’s Next for Litecoin (LTC) Everyone’s excited about 2018. Litecoin (LTC) communities expect a big December with all the Holiday nest eggs created over all the recent hype.

The Litecoin Cash (LCash anyone?) will be forking at Litecoin block which should occur on or around February 19th, 2018 will have a 10:1 claim ratio for Litecoin (LTC) users holding their coins in a local wallet or a compatible exchange or service that will support LCC. The maximum LCC supply will also be 10 times higher. Litecoin Price Prediction For 2018, Litecoin Background, Comparison with Bitcoin, Litecoin Analysis and Forecast for Future.

In January a slide might take place which this gives you an advantage to improve your market position and expect a significant increase towards the Summer. One big thing Litecoin has in its favor is that its community is very vocal, especially the creator and founder Charlie Lee, former Google employee. My bet is that we hit the trillions at the start of the Q2 of 2018.

If this happens we’ll start to see, given that Litecoin (LTC) follows through with the most recent announcements, Litecoin might reaffirm its position on the podium. So, in terms of predictions, I would say IMO that Litecoin (LTC) can easily reach the 300 USD mark by February 2018. Litecoin (LTC) Project For those of you who don’t know Litecoin (LTC) that well it is a peer-to-peer cryptocurrency software. The so called Blockchain is the structure behind the database of this software. By a decentralized cryptographic method this software cannot be managed by any central authority, it has no administrator, it works for roles for their miners and users. Charlie Lee, founder of Litecoin (LTC) decided to create a fork (cloned software) of the Bitcoin(BTC) protocol.

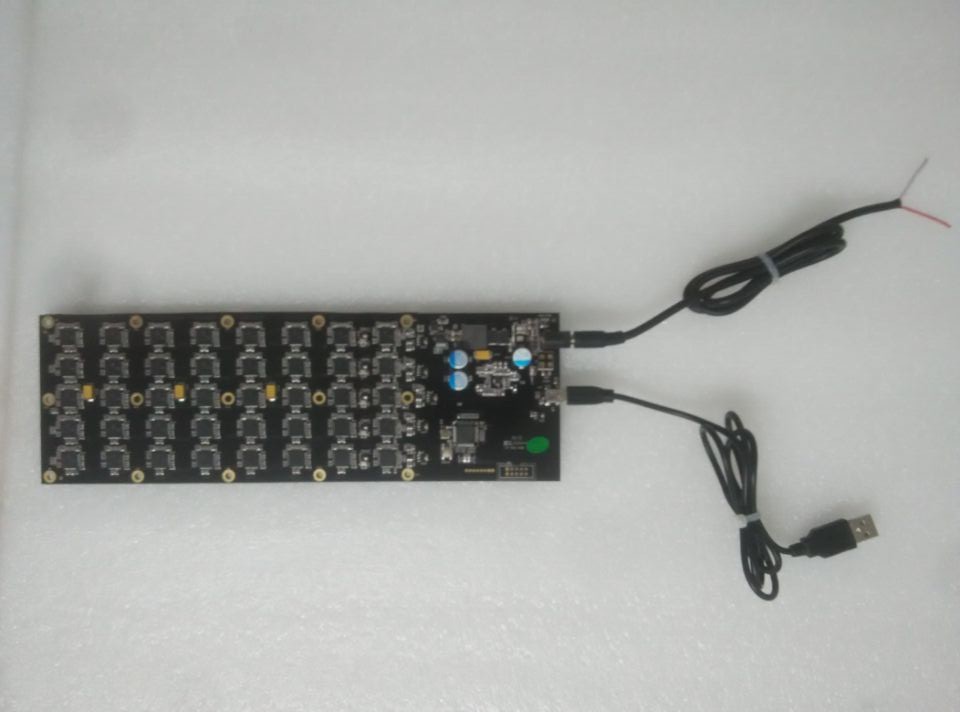

He added what he thought the chain needed and created Litecoin (LTC). His additions were a smaller generation of time needed to create a block, more tokens, different hash (cryptographic algorythim) and a different Graphical User Interface. Litecoin (LTC) reached for the first time the 1 billion-dollar mark back in 2013 after a major breakthrough that led Litecoin’s jump of 100% in just 24 hours. Big leaps have happened since and markets look like they continue to show improvements despite criticism. Litecoin was one of the first to implement Segregated Witness to their project. Litecoin’s usage of script algorithmics makes devices that run a higher computing power like FPGA’s and ASIC have a hard time getting better results. This translates in attempting to bring more equality towards mining than on SHA-256, hashing protocol used in Bitcoin.

Bitcoin, Ethereum, and Litecoin have yet for finding their bottom. All three seem to be consolidating in preparation for a breakout in one direction or the other. The price action of Bitcoin seems to be where all the attention is currently focused. Bitcoin (BTCUSD) Bitcoin continues to hover near the $10,000 price level where it has encountered support. On January 16 th, Bitcoin made a sharp drop from $13,617, to a low of $9760.00 breaking below the $10,000 price level for the first time since it hit its all-time high near $20,000 in mid-December. Peercoin PPC Mining Safe.

When Bitcoin broke through the $10,000 price mark last November 29, 2017, on its way up, the financial news media went absolutely crazy over the cryptocurrency, bringing a great deal of attention to it, and in many ways creating an “irrational exuberance” among newcomers to the market, leading to the significant rise in demand, and the rapid price increase. As can be seen in Chart #1 below, it took Bitcoin less than three weeks to go from $10,000 to its all-time high near $20,000. Who’s to say that is can’t happen again. However, the retracement to the $10,000 level once again has the financial media in a “Tizzy,” this time for a doom-and-gloom scenario. And once again, the news is drive prices. Chart#1 Bitcoin Daily The Bitcoin daily chart above is showing more downward price tendency with a descending triangle pattern forming.

However, the $10,000 level is definitely a key support level for Bitcoin and the entire cryptocurrency market. Anyone that is involved in the cryptocurrency market is watching bitcoin’s price action to see which way price breaks. A significant move in either direction will cause the “herd to stampede” and the price move will be greatly amplified.

The savvy trader will pay close attention the volume patterns in the intraday price charts. They will reveal early on which way price will break. Ethereum (ETHUSD): Ethereum is the only one of the three cryptocurrencies I this article showing any indication of breaking to the upside.

As can be seen in Chart #2 below, the Euthereum daily chart is showing an inverted head-and-shoulder price pattern forming. This pattern is typically an indication of a price reversal to the upside. Ethereum’s volume is below its normal average. When Bitcoin makes a move away from the $10,000 price level, in all likelihood, Ethereum will move with it. If the price move is to the upside, Ethereum is primed to make new all-time highs. Ethereum (ETHUSD): Litecoin (LTCUSD): Litecoin’s price action is mirroring Bitcoins.

Chart #3 below shows how Litecoin is trading at the apex of a descending triangle pattern for which it has broken slightly below the lower support level line. Volume for Litecoin is very light, and the price seems to be reacting to moves by Bitcoin. Chart#3 Litecoin Daily In the cryptocurrency market where fundamentals are virtually non-existent, news and the bell-weather assets drive the market. From a technical analysis perspective, entire cryptocurrency is currently lumbering around with light volume, and no momentum, waiting for something to happen. The next few days may bring about some price movement that may spark some volatility.

We will be updating our subscribers as soon as we know more. For the latest ICOs, sign up below! Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency. Image courtesy of. Towards the end of last week, we took an objective look at the action we were seeing in the cryptocurrency markets and tried to pick out a few coins that we felt had the biggest potential for turnaround once the markets recovered.

As anyone who caught our coverage will already be aware, one of our top picks (and the one that we suggested was probably the most secure coin outside of the majors) was Ripple (XRP). Our thesis was relatively simple. Ripple had tanked in line with wider markets but, unlike many of its competitor coins and peers in this space, the company behind the currency had been pushing forward from an operational perspective and was making some real headway in terms of enterprise-level adoption of its flagship technology.

XRP Daily Chart In turn, we suggested that this divergence (between the company’s operational developments and the price of XRP, its representative token) represented a real opportunity to pick up some cheap coins in anticipation of the gap closing out. And as it turns out, we were spot on. At the time of our coverage, XRP had dipped as low as $0.63 a piece. Remember, this is a coin that was trading in excess of $3 just a few weeks ago.

Then, late on Friday,. For those that didn’t catch the news, Santander announced in its quarterly review that the company would be rolling out a mobile device application this year that will support free, instant cross-border transactions for its users in Spain, Brazil, the U.K. And the technology on which the application rests? Ripple’s xCurrent, of course. Ripple chief executive Brad Garlinghouse announced the move to his followers on Twitter, noting that the app will be released this quarter, and Santander followed up the announcement with a dedicated section in its quarterly presentation, with a spokesperson saying: “We plan to launch this in the next few months, and we can confirm on the record that we plan to use xCurrent in the project.” There’s no denying it – this is a really big deal for Ripple. Indeed, it’s a big deal for the cryptocurrency space as a whole. For the first time, an incumbent in the financial sector has taken a blockchain based technology and bundled it into a use case that’s aimed at the general public, as opposed to being aimed at another financial institution.

To put this another way, Ripple has finally been able to bridge the gap between the bleeding edge of blockchain technology and the mainstream general public. So where do things go from here? Well, this is one example of Ripple’s pilot programs coming to fruition. That is, making the jump from pilot program to commercial application. With a large number of these programs ongoing, this latest news reinforces the suggestion that there’s real value in the ongoing programs and that they will likely bridge through to commercial use once the programs in question complete.

It’s important to note that XRP won’t play a role in the Santander application – at least not initially – but this isn’t too much of a big deal. It’s a major vindication of the company’s ability to score big-name partners and, for us, is a strong signal that Ripple remains one of the top recovery plays in the market right now. We will be updating our subscribers as soon as we know more. For the latest on XRP, sign up below! Disclaimer: This article should not be taken as, and is not intended to provide, investment advice.

Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency. Image courtesy of Ripple. The cryptocurrency markets have taken a real beating over the last couple of weeks and especially throughout this week, with many of the major coins (bitcoin, Litecoin, etc.) trading at a more than 50% discount to their price just a few days ago. This, of course, has translated to a real weakening of sentiment and the confidence that many of the later entrants had in their (arguably late entry) positions has all but dried up.

People are exiting the market in spades and the selloff is resulting in a further weakening of price. This, in turn, is translating to more panic and an increased number of market exits and so on and so on. This sort of action will be familiar to many. It’s a self-fulfilling spiral that compounds sentiment and it’s essentially the opposite of what caused bitcoin and its peers to run up into the end of last year. Late entrants forming weak and fundamentally inaccurate biases and responding to these biases by pulling the trigger. In November and December, it was a trigger pulled on a buy position.

In January, the trigger is being pulled on a sell. The thing is, now is not the time to sell.

Sure, markets got overexcited at the end of last year and some coins ran up farther than they perhaps might have done if the crypto space had of remained under the radar. Sure, the entry of a futures market and the concurrent wave of media coverage that came with bitcoin shifting into the mainstream consciousness perhaps created a buying frenzy which, in turn, pushed prices above and beyond sustainable levels. BTC Daily Chart When this happens, however, we generally see a correction, a bottoming out, some degree of rationality return to a market and, in turn, a return to the overarching trend which, in this case, very much remains to the upside. People forget that Bitcoin (BTC) was trading below $900 this time last year.

Litecoin (LTC) was at $5 twelve months ago. Some of the more functional tokens, things like Ripple (XRP), were trading for fractions of a penny. Many didn’t even exist.

What we’re trying to say here is that the vast majority of coins that exist in today’s market and that are down circa 50% or so on early month January highs remain up thousands of percentage points on their respective twelve-month pricing. Put things in perspective, then, and you see that this pullback is a natural correction on an overheated market and one that simple serves up a long overdue return to sensibility, as opposed to any indication that the cryptocurrency run has come to an end. For those who need a bit of persuasion, look at this space as if it’s a thirty-year trend, a long-term technological shift. We’re less than a decade into it and while exuberance led to the space running away with itself a little, the excitement is now reigned in and the industry can resume on the path towards changing the technological (and indeed, global industrial) landscape of the future. Bottom line: let the panic sellers exit their positions cheap and, if you’ve got the capital, pick up some cheap coins as they unload. When things return to normal, the same sellers will be scrambling to buy back their coins and will be forced to do so at a premium to the rice at which they’re unloading them right now. We will be updating our subscribers as soon as we know more.

For the latest on Bitcoin, Ripple and Litecoin, sign up below! Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency. Image courtesy of Global Coin Report Archives.

2017 saw a massive increase in awareness of cryptocurrency thanks to the huge increase of Initial Coin Offerings (ICOs). Investors swarmed the numerous new coins available, making it the must-have investment product of the year (well, up until the end that is.) The reason for its success and failure as an investment tool is due to the simple fact that the coins were meant to be used in daily life – all that was missing is the infrastructure needed to make it easy.

Yet The Current System Doesn’t Work However, there are two issues surrounding utilizing cryptocurrency in daily life. The first is that few retailers accept cryptocurrency at all. The second is that those who do accept these digital currencies typically only accept one out of the dozens of varieties available. Meaning it is possible to have a fortune of cryptocurrency in your pocket and be unable to spend a single penny of it. Bitcoin, Litecoin, Ethereum, and more are being actively traded every day with new coin systems being minted just as quickly. With an estimated total market capitalization of $660 billion, there is a great deal of opportunity for ICOs to help spur the next stage of consumer spending and economic growth, but ICOs will have to bridge the divide between digital and physical. How can we solve this challenge?

Take MoxyOne, for example. It was founded with the simple goal of providing the infrastructure needed to help ICOs make the transition from an investment vehicle to viable currency. For its part, MoxyOne provides white-label services for companies seeking to offer a complete cryptocurrency solution for their investors and clients. This includes a “banking” solution that makes spending the coins as easy as swiping the provided debit card. Beyond working with other coin platforms, MoxyOne is also offering its own cryptocurrency known as SPEND tokens, offered for distribution through the respectable Cryptopia exchange platform. More platforms are coming soon, as well. MoxyOne’s Exchange Listing Consultant Rick Kennernecht is working to secure new partnerships with a wide variety of exchange platforms such as EtherDelta.

Recent successes in this endeavor include a partnership with the Decentralized Social Networking Platform Social (SCL). How to Integrate Digital Wallets with Physical Debit Cards By using the latest in digital wallet technology, MoxyOne has made it possible to securely handle transactions worldwide wherever debit and credit cards are accepted. All the end-user needs to do is install the app and activate the card – from there it is as simple as managing a traditional bank account, without the fees.

This works through the implementation of Just In Time Funding (JITF) which allows for the instant sell of cryptocurrency into the required traditional currency as the user spends it. This means that the greatest hassle involved in modern cryptocurrency – using it in the real world – has been eliminated in a way that is completely seamless for the end-user. The only fee incurred is the traditional platform exchange fee built into all cryptocurrency platforms. This platform will be released in early 2018, with a pre-sale beginning February 8, 2018, and ending on March 10, 2018. The public ICO starts March 14, 2018, until April 14, 2018. MoxyOne will leverage Raiden Network’s micropayment technology for speed and Gladius’ DDoS technology for stability and overall security. Long-term goals will include integrating with the COMIT network for increased blockchain interoperability and overall access.

In addition to JITF, we enable individual organizations and buyers to obtain the cryptocurrency directly from the holder. In addition to receiving the coins, a number of extra tokens will be provided to cover any extra expenses.

This will help grow the platform and incentivize end users to utilize every feature of the MoxyOne platform. Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Global Coin Report and/or its affiliates, employees, writers, and subcontractors are cryptocurrency investors and from time to time may or may not have holdings in some of the coins or tokens they cover. Please conduct your own thorough research before investing in any cryptocurrency.